The State of Indian Fintech Report – H1 2025: Lending Tech, AI and Market Shifts

India’s fintech landscape in 2025 is undergoing a significant transformation. Driven by a combination of maturing infrastructure, increased digital adoption and a rising middle class, the sector is rapidly expanding across lending, payments, insurtech and digital banking. Among all segments, lending tech is emerging as the central pillar powered by AI, data integrations and changing consumer behavior.

According to the Inc42 H1 2025 Fintech Report, India is not only scaling in terms of user numbers and investment but is also redefining how credit is issued, serviced and recovered.

Fintech Market Outlook: Strong Growth Projections

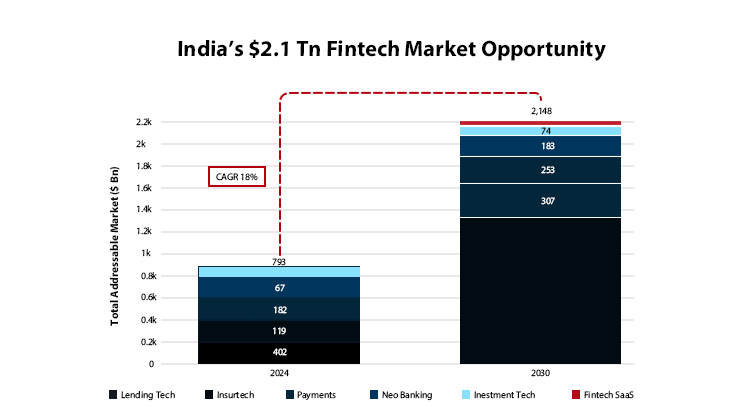

India’s total fintech market is projected to reach $2.1 trillion in size by 2030, with a revenue potential between $190–250 billion. Digital lending is expected to capture more than 53% of this revenue, translating to $133 billion by the end of the decade.

Key figures:

- $250 billion fintech revenue projected by 2030

- $133 billion expected from lending tech

- Lending tech CAGR (2015–2024): 31%

- Fintech startup funding CAGR (2015–2024): 6%

Lending Tech: Leading the Sector’s Momentum

Lending startups have attracted the largest share of fintech funding in recent years, supported by regulatory clarity, digital infrastructure and investor confidence.

From 2020 to H1 2025:

- Lending tech accounted for 37.3% of all fintech funding

- Over $8.2 billion invested in the segment

- Lending tech received the highest number of unique investors

Major contributors to growth:

- Faster credit approvals through automated underwriting

- Better risk profiling using transaction and utility data

- Cost savings through automation of onboarding and servicing

Funding Landscape: Capital Moving Towards Growth-Stage Startups

Between 2020 and H1 2025, over $22 billion was invested across Indian fintech startups, with a clear trend emerging:

- Seed funding declined 21% YoY in H1 2025

- Growth-stage funding tripled during the same period

- Median ticket size of investments increased by 46%

This shift reflects a maturing ecosystem where investors are backing scalable businesses with tested models, particularly in lending, fintech SaaS and insurtech.

The Role of AI in Lending Workflows

AI is becoming a core component of modern lending infrastructure. Companies are integrating machine learning and generative models across the credit lifecycle:

Core applications:

- Lead scoring and loan discovery

- Automated KYC and fraud detection

- Real-time credit scoring using alternate data

- Predictive recovery strategies

Case studies:

- Bajaj Finance reported savings of ₹150 crore per year using GenAI bots in customer service and sales

- Tata Capital reduced customer service costs by 20% and shortened turnaround time from 24 hours to 20 minutes

- Mid-sized banks observed a 34–36% drop in credit disbursement and collection costs due to AI adoption

Digital Lending Demand: What’s Driving It?

Several demand-side and supply side factors are supporting the rise of digital lending:

Demand Side:

- Millennials and Gen Z now form 50% of India’s population, preferring digital, mobile-first borrowing experiences

- Aspirational spending is rising; by 2030, 23 million households are expected to earn more than ₹20 lakh annually

- Gig economy workers and first-time borrowers need flexible, low-documentation credit solutions

Supply Side:

- MSMEs face a $240 billion credit gap, with only 16% served by formal banks

- Embedded finance and Banking-as-a-Service are enabling credit access through non-banking platforms

- India Stack (Aadhaar, UPI, DigiLocker, Account Aggregators) has reduced onboarding costs by up to 90%

Loan Book Trends: Consumers Now Dominate

As of FY25, India’s $2.2 trillion + loan book is dominated by consumption loans:

| Loan Type | FY22 | FY25 | Growth (%) |

| Credit Cards | $21B | $44B | 110% |

| Two-Wheeler Loans | $10B | $19B | 90% |

| Personal Loans | $95B | $172B | 81% |

| Home Loans | $321B | $478B | 49% |

Personal loans are the fastest-growing by volume, with new personal loans doubling from 73 million to 146 million in three years.

Fintech Startup Ecosystem: Funding, Scale and Market Reach

- Over 830 fintech startups have been funded in India since 2014

- There are currently 26 fintech unicorns and 35 soonicorns

- Bengaluru leads as the top startup hub, followed by Delhi NCR and Mumbai

- Fintech M&A activity jumped 25% YoY in H1 2025

Top funding rounds (H1 2025):

- Zolve ($251M)

- Acko ($202M)

- Lendingkart, Perfios and Credgenics among other high-ticket deals

AI Lending Startups Reshaping Credit Infrastructure

Notable players across funding stages:

| Startup | Focus Area |

| Arya.AI | AI for underwriting and document processing |

| Binocs | AI-generated credit assessment memos |

| Perfios | Risk assessment and fraud detection tools |

| Zeta | Infrastructure for embedded lending |

| Signzy | KYC automation and digital onboarding |

| Haptik, Gupshup | Conversational AI for financial services |

Fintech Stocks: Public Market Pressure in 2025

Despite strong funding and operational metrics, fintech stocks have seen steep corrections:

- Some firms lost 58–61% of value in H1 2025

- Volatility was attributed to macroeconomic conditions rather than sector fundamentals

- New-age listed tech companies are reassessing growth strategies to regain investor trust

What’s Next for Indian Fintech?

As digital lending continues to grow, several trends are expected to shape the future:

- Consolidation through acquisitions of smaller AI startups

- Expansion into NRI and cross-border credit markets

- Better credit access through partnerships between banks, NBFCs and fintechs

- Greater use of alternate credit data for risk modeling

The second half of 2025 will likely see deeper shifts in how India builds and scales fintech businesses, especially in lending. Several key signals from the H1 2025 report point toward the sector’s evolving direction:

1. Focus on Lending Tech Will Intensify

Lending continues to draw the most capital and investor interest. With over 36% of fintech deals going to lending startups and a 49% share of unique investors, this segment will remain central. By 2030, lending tech alone is projected to generate $133 billion, accounting for 53% of India’s fintech revenue.

2. Shift in Investor Strategy

Seed-stage funding is slowing down 21% YoY in H1 2025 while growth stage capital surged 3x, reflecting a preference for de-risked, scalable models. Fintechs that demonstrate revenue traction and AI integration are now seeing larger rounds and more strategic interest.

3. Rise in AI-Driven Infrastructure and Acquisitions

Established fintechs are increasingly acquiring native AI startups like Hyperbots AI, On Finance AI and Arya AI to strengthen their product stacks. This wave of vertical consolidation is being driven by demand for faster onboarding, fraud control and credit personalization.

4. Fintechs Serving NRIs Are Gaining Ground

Startups catering to non-resident Indians are attracting substantial funding. Zolve’s $251 million round, the largest in early 2025, signals growing appetite in this space, along with interest in global credit access and cross-border financial services.

5. Payments and Banking Are Losing Share

While still important, traditional segments like payments and core banking are seeing reduced investor interest. From 2015–2020, they attracted 56% of fintech capital, but their share dropped to 28% between 2021 and H1 2025. In contrast, lending tech has become the primary engine of growth.