INDMoney Podcast

It was my pleasure to feature on the INDmoney podcast on my favourite topic – 𝑭𝒊𝒏𝒂𝒏𝒄𝒆, in discussion with Shobha Makkar.

This was shot in September 2025, so you can relate. Yes, first time this has been recorded at my residence.

Please note that I am not a financial advisor. I am just sharing my experience.

I have also included a few behind-the-scenes pics along with the crew..!!! Eager to hear your feedback.

The podcast link

BirenParekh InvestorTalk PersonalFinanceIndia WealthCreation FinancialFreedom AssetAllocation MoneyMindset PassiveIncome EarlyRetirement

TMM 2026 – Conquered

They say, “𝑹𝒖𝒏 𝒍𝒊𝒌𝒆 𝒂 𝑴𝒖𝒎𝒃𝒂𝒊kar.”

At 𝐓𝐌𝐌 𝟐𝟎𝟐𝟔, that wasn’t just a phrase—it was the spirit.

In a city that never sleeps, 𝑾𝒉𝒆𝒏 𝑴𝒖𝒎𝒃𝒂𝒊 𝒓𝒖𝒏𝒔, 𝑩𝒐𝒎𝒃𝒂𝒚 𝒕𝒓𝒖𝒍𝒚 𝒑𝒂𝒖𝒔𝒆𝒔.

Proud to complete my 7️⃣th Full Marathon 🏃♂️🏃♂️with:

🔹0 practice

🔹0 coaching

🔹0 supplements (protein, gels)

🔹100% pure vegetarian

🔹200% willpower

Crossing the finish line 🏁 was a powerful reminder: 𝒀𝒐𝒖 𝒄𝒂𝒏 𝒅𝒐 𝒎𝒐𝒓𝒆 𝒕𝒉𝒂𝒏 𝒚𝒐𝒖 𝒕𝒉𝒊𝒏𝒌 𝒚𝒐𝒖 𝒄𝒂𝒏.

Seeing the last milestone en route – 𝟑𝟎𝟎 𝐦𝐞𝐭𝐞𝐫𝐬 𝐭𝐨 𝐠𝐨 – was one of the most delightful sights of the year for me..

Tata Mumbai Marathon is the largest marathon in Asia as well as the largest mass participation sporting event on the continent. It is the richest race in India with a prize pool of US$405,000 (or more)!!!

With record-breaking 68,000 runners this time, it is the biggest conclave of the fitness enthusiasts, runners, and dreamers in India!!!

This year’s course was tougher with added elevation due to the Coastal Road inclusion, but also more scenic than ever.

A sunrise like that is a once-a-year privilege.

Grateful for kind weather (lower temperatures, reduced humidity, improved AQI) and for the incredible energy of the crowd, from 80+ year-old supporters to persons with disabilities cheering us on. The warmth and hospitality along the route were truly overwhelming.

The quirky placards along the way helped distract from the pain and brought much-needed smiles.

A special shoutout to the Greater Mumbai Police for their seamless coordination and unwavering support — exemplary execution in a city that never slows down.

Completing a full marathon feels like an annual health check-up > no lab reports required.

And yes, timing was better than last year’s, although not my personal best, but that is what you get with no practice.!!!

More pics at https://www.linkedin.com/feed/update/urn:li:activity:7419223501078880256/

Tired, grateful, and already curious…

🤔𝐖𝐡𝐚𝐭’𝐬 𝐭𝐡𝐞 𝐧𝐞𝐱𝐭 𝐜𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞??

HarDilMumbai TMM2026 MumbaiMarathon RunLikeMumbai MarathonFinisher EnduranceMindset MindOverMatter

PersonalExcellence LifelongLearning LeadershipThroughAction

Resilience GrowthMindset

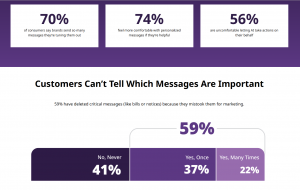

𝟐𝟎𝟐𝟔 – 𝐒𝐭𝐚𝐭𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐄𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞 𝐑𝐞𝐩𝐨𝐫𝐭

Most brands think they have a technology problem.

The data suggests they actually have a clarity problem.

I recently read the 2026 State of Customer Experience Report (The Financial Brand) and one theme stood out sharply:

Customers are not disengaging because brands lack tools, they are disengaging because brands are overwhelming them.

The numbers are hard to ignore:

-

70% have stopped caring because of excessive messaging

-

59% have stopped buying because of over-communication

-

34% have churned altogether

-

65% fear missing critical information because they now ignore most brand messages

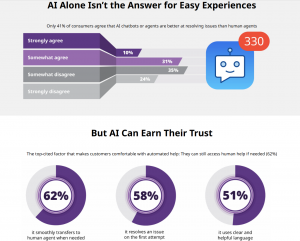

What surprised me most is the misplaced faith in AI as the solution.

Only 41% find chatbots more effective than humans.

56% are uncomfortable letting AI take actions on their behalf.

Trust still comes before automation.

The real drivers of loyalty are not futuristic:

-

Helpful communication

-

Appropriate frequency

-

Transparent pricing

-

Reliable service

This challenges a lot of current enterprise behavior.

More personalization is not the answer.

More automation is not the answer.

More messages are definitely not the answer.

Better judgment is.

The brands that will win in 2026 will not be the ones shouting louder.

They will be the ones that communicate less, but better.

Curious to hear from others working in CX, product, and digital strategy:

Are we designing experiences for customers, or for our dashboards?

CustomerExperience CX DigitalExperience UserExperience CustomerFirst AIinCX ResponsibleAI HumanCenteredAI Automation DigitalTransformation Leadership BusinessStrateg Growth ProductManagement Innovation FutureOfWork Trends2026 TechTrends CXTrends ThoughtLeadership

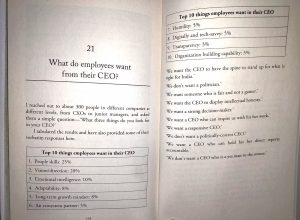

CEO Desirable Qualities

Many believe AI will take away jobs.

The more nuanced reality is that AI will not take away what makes leaders effective: their humanity.

In his book The CEO Mindset, Shiv Shivakumar interviewed 300 professionals across roles and organizations with a simple question:

“What are the top three qualities you look for in your CEO?”

The findings are telling. A significant portion of what people value most in leaders comes from human capabilities:

-

People skills: 25%

-

Emotional intelligence: 10%

-

Humility: 5%

-

Transparency: 3%

Together, these soft skills account for 42% of the attributes respondents value most in a CEO, outweighing technical and functional expertise.

As AI continues to advance, the premium on human leadership will only increase.

For anyone aspiring to leadership roles, this is a timely reminder of where to invest their development.

Curious to hear your perspective:

What is the one quality you value most in your CEO?

HumanLeadership CEOPowerSkills SoftSkills LeadershipDevelopment EmotionalIntelligence TransformationalLeadership PeopleFirst ExecutiveCoaching WorkplaceCulture LeadershipExcellence #ShivShivaKumar

Indian Banking and Finance report 2025

Just went through the latest 𝗜𝗕𝗙𝗥 𝟮𝟬𝟮𝟱 (Indian Banking and Finance report 2025), and here are key points:

No doubt that – India’s financial sector is evolving faster than ever – and the next decade will belong to those who can navigate disruption with resilience and imagination.

🚀 India stays the world’s 𝐟𝐚𝐬𝐭𝐞𝐬𝐭-𝐠𝐫𝐨𝐰𝐢𝐧𝐠 𝐦𝐚𝐣𝐨𝐫 𝐞𝐜𝐨𝐧𝐨𝐦𝐲 with GDP of 8.2 for Q3 2025 – with strong fundamentals and steady financial markets, despite global trade headwinds.

🏙️ Urban India needs 𝐬𝐦𝐚𝐫𝐭𝐞𝐫 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐧𝐠 – municipal bonds are poised to become a game-changer for sustainable city infrastructure.

🌱 𝐄𝐒𝐆 = 𝐁𝐞𝐭𝐭𝐞𝐫 𝐛𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐨𝐮𝐭𝐜𝐨𝐦𝐞𝐬 – banks with stronger disclosures & climate performance show stronger profitability. Climate finance is now a core strategy, not just CSR.

⚠️ 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞 𝐢𝐬 𝐠𝐞𝐭𝐭𝐢𝐧𝐠 𝐬𝐡𝐚𝐫𝐩𝐞𝐫 – penalties hit market valuations, reinforcing that governance is a competitive advantage. RBI & SEBI on roll!!!

🏦 NBFCs face rising 𝐜𝐫𝐞𝐝𝐢𝐭 & 𝐥𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐩𝐫𝐞𝐬𝐬𝐮𝐫𝐞s – demanding stronger stress testing and ALM discipline.

🤖 AI is moving from “𝐬𝐮𝐩𝐩𝐨𝐫𝐭” to “𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐲” – from customer engagement to HR, LLMs are reshaping how banks operate and compete.

💛 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐛𝐞𝐡𝐚𝐯𝐢𝐨𝐮𝐫 𝐢𝐬 𝐬𝐡𝐢𝐟𝐭𝐢𝐧𝐠 – convenience, UI, and brand trust now drive cross-buying more than just traditional levers.

👩💼 𝐖𝐨𝐦𝐞𝐧-𝐥𝐞𝐝 𝐛𝐚𝐧𝐤𝐬 𝐬𝐡𝐨𝐰 𝐥𝐨𝐰𝐞𝐫 𝐍𝐏𝐀𝐬 & 𝐟𝐞𝐰𝐞𝐫 𝐩𝐞𝐧𝐚𝐥𝐭𝐢𝐞𝐬s – a powerful insight into leadership impact.

𝑩𝑭𝑺𝑰 𝒊𝒔 𝒔𝒕𝒂𝒏𝒅𝒊𝒏𝒈 𝒂𝒕 𝒕𝒉𝒆 𝒄𝒓𝒐𝒔𝒔𝒓𝒐𝒂𝒅𝒔 𝒐𝒇 𝒄𝒍𝒊𝒎𝒂𝒕𝒆, 𝒄𝒐𝒎𝒑𝒍𝒊𝒂𝒏𝒄𝒆, 𝒂𝒏𝒅 𝒄𝒐𝒎𝒑𝒖𝒕𝒂𝒕𝒊𝒐𝒏𝒂𝒍 𝒊𝒏𝒕𝒆𝒍𝒍𝒊𝒈𝒆𝒏𝒄𝒆 𝒂𝒏𝒅 𝒕𝒉𝒐𝒔𝒆 𝒘𝒉𝒐 𝒊𝒏𝒕𝒆𝒈𝒓𝒂𝒕𝒆 𝒂𝒍𝒍 𝒕𝒉𝒓𝒆𝒆 𝒘𝒊𝒍𝒍 𝒅𝒆𝒇𝒊𝒏𝒆 𝑰𝒏𝒅𝒊𝒂’𝒔 𝒇𝒊𝒏𝒂𝒏𝒄𝒊𝒂𝒍 𝒇𝒖𝒕𝒖𝒓𝒆.

DM me for the full report.

Banking BFSI Finance FinancialServices InvestmentBanking Fintech WealthManagement RiskManagement DigitalBanking Bankingreport FinancialLiteracy

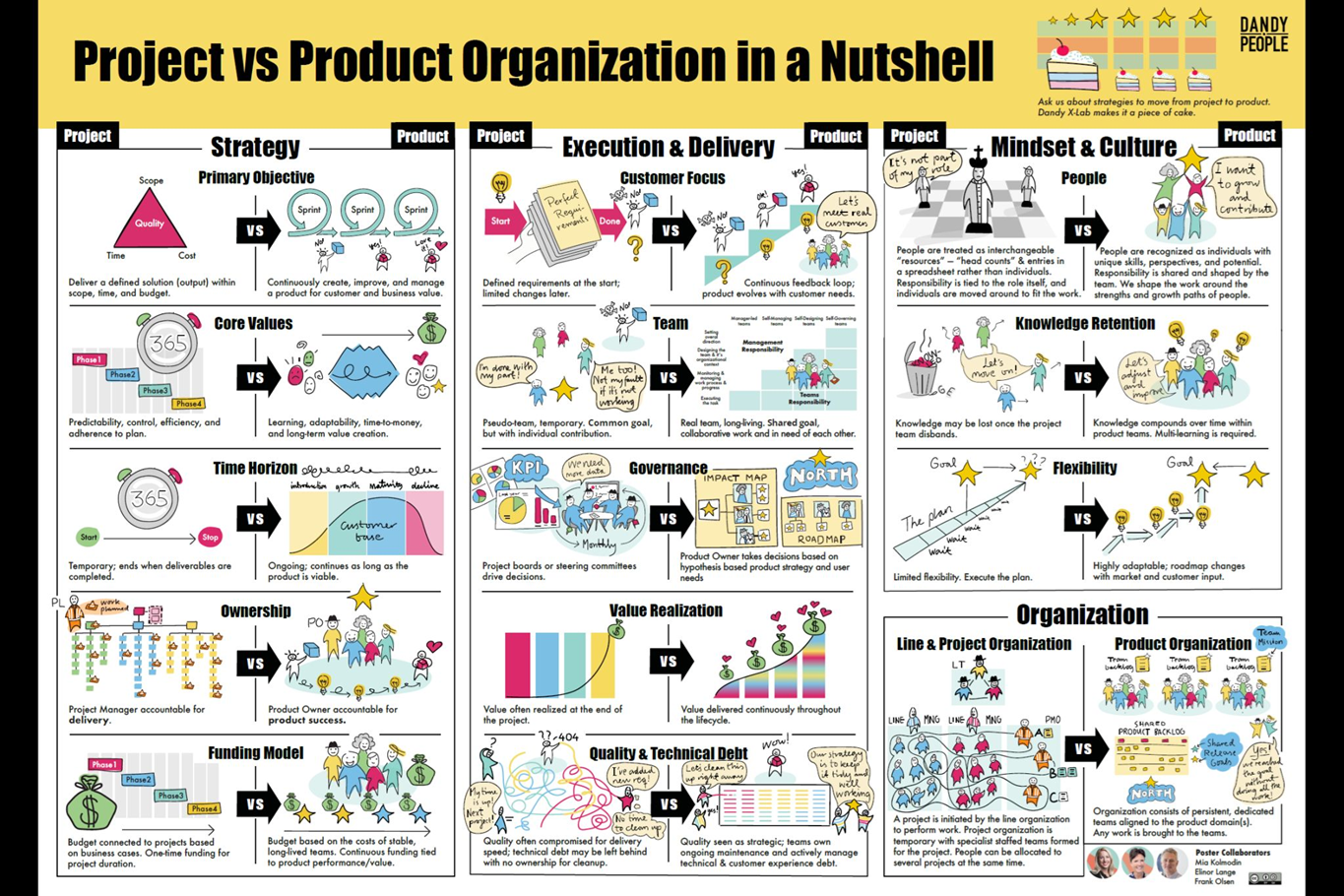

Project v/s Product Organization

In discussions, the debate often centers on which is better: a project or a product organization.

This nice infographic, prepared by Dandy People contrasts project and product organizations, highlighting their strategic objectives, governance, execution, and cultural differences. It’s quite easy and gives a bird’s eye view.

📌𝐏𝐫𝐨𝐣𝐞𝐜𝐭 𝐯𝐬. 𝐏𝐫𝐨𝐝𝐮𝐜𝐭 𝐎𝐫𝐠𝐚𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧

——————————————

🔸𝘗𝘳𝘪𝘮𝘢𝘳𝘺 𝘖𝘣𝘫𝘦𝘤𝘵𝘪𝘷𝘦: Projects focus on delivering defined solutions within set parameters, while product organizations emphasize continuous value creation and adaptability.

🔸𝘊𝘰𝘳𝘦 𝘝𝘢𝘭𝘶𝘦𝘴: Projects prioritize predictability and efficiency, whereas products value learning and long-term growth.

🔸𝘖𝘸𝘯𝘦𝘳𝘴𝘩𝘪𝘱 𝘢𝘯𝘥 𝘈𝘤𝘤𝘰𝘶𝘯𝘵𝘢𝘣𝘪𝘭𝘪𝘵𝘺: Project Managers oversee delivery, while Product Owners are responsible for overall product success and strategy.

🔸𝘍𝘶𝘯𝘥𝘪𝘯𝘨 𝘔𝘰𝘥𝘦𝘭: Projects receive one-time funding based on business cases, while product organizations benefit from ongoing funding linked to performance.

📌𝐓𝐞𝐚𝐦 𝐃𝐲𝐧𝐚𝐦𝐢𝐜𝐬 𝐚𝐧𝐝 𝐂𝐮𝐥𝐭𝐮𝐫𝐞

————————————–

🔸𝘛𝘦𝘢𝘮 𝘚𝘵𝘳𝘶𝘤𝘵𝘶𝘳𝘦: Project teams are temporary and often lack cohesion, while product teams are long-lasting, collaborative, and self-managing.

🔸𝘒𝘯𝘰𝘸𝘭𝘦𝘥𝘨𝘦 𝘙𝘦𝘵𝘦𝘯𝘵𝘪𝘰𝘯: Knowledge may dissipate after project completion, whereas product teams accumulate and retain knowledge over time.

🔸𝘍𝘭𝘦𝘹𝘪𝘣𝘪𝘭𝘪𝘵𝘺 𝘢𝘯𝘥 𝘈𝘥𝘢𝘱𝘵𝘢𝘣𝘪𝘭𝘪𝘵𝘺: Product organizations adapt their roadmaps based on customer feedback, while project organizations adhere strictly to initial plans.

📌𝐐𝐮𝐚𝐥𝐢𝐭𝐲 𝐚𝐧𝐝 𝐓𝐞𝐜𝐡𝐧𝐢𝐜𝐚𝐥 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭

———————————————-

🔸𝘘𝘶𝘢𝘭𝘪𝘵𝘺 𝘍𝘰𝘤𝘶𝘴: Projects may compromise quality for speed, leading to technical debt, while product teams prioritize quality and actively manage ongoing maintenance.

🔸𝘎𝘰𝘷𝘦𝘳𝘯𝘢𝘯𝘤𝘦: Project decisions are made by steering committees, while product decisions are driven by user needs and strategic hypotheses.

—

This summary encapsulates the fundamental distinctions between project and product organizations, emphasizing their differing approaches to strategy, team dynamics, and quality management.

#ProjectManagement #ProductStrategy #ExecutionExcellence #DeliverySuccess #TeamCulture #AgileMethodology #StrategicPlanning #LeadershipDevelopment #InnovationInExecution #CollaborationMatters

Leadership Excellence Award

I was surprised and humbled to receive the Top 1% Leader – Excellence in Leadership Award 🏅from Flexi Roundtables : Top 1% Leaders during the recent award ceremony.

I was surprised and humbled to receive the Top 1% Leader – Excellence in Leadership Award 🏅from Flexi Roundtables : Top 1% Leaders during the recent award ceremony.

My heartfelt thanks to Flexi Roundtables : Top 1% Leaders and OpsTree Global for the recognition and for inviting me to be part of this leadership felicitation event.

It was great to meet industry leaders & stalwarts like Shiv Kumar Bhasin, Manju Dalvi and several others. It was a privilege to be among such accomplished industry leaders.

Grateful for the continued support of my colleagues, seniors, and mentors for the wonderful professional journey.

Thanks to Gaurav Sharma, Ishi Tripathi for the wonderfully organized event and recognition.

OpsTree Global leads the industry with high-performance DevOps, DevSecOps, cloud engineering, and platform reliability.

To my surprise, it was also covered by media – https://www.financialexpress.com/events/leadership-excellence-awards-2025

#Leadership #Top1PercentLeader #Recognition #EngineeringLeadership #OpsTree #FlexiRoundtables #Sonatype #TechLeadership

Invite a Financial Speaker to Discuss Strategic Innovation for Business Growth

Businesses need more than traditional financial planning to grow sustainably. Strategic innovation in finance plays a critical role in shaping smarter decisions, scalable systems, and long-term profitability. One of the most effective ways to introduce this mindset into your organization or event is to invite a financial speaker who specializes in strategic innovation.

Why Strategic Financial Innovation Matters for Businesses

Financial innovation goes beyond budgeting and forecasting. It focuses on aligning financial strategy with technology, operations, and business goals. Companies that adopt innovative financial thinking are better prepared to manage risk, improve efficiency, and identify new growth opportunities.

A financial speaker with expertise in strategic innovation helps organizations understand how modern financial frameworks support digital transformation, automation, and data-driven decision-making.

How a Financial Speaker Adds Value to Business Growth

Inviting a financial speaker to your conference, leadership session, or corporate workshop brings real-world insights that inspire action. These speakers combine experience, case studies, and practical strategies that leaders can apply immediately.

Key benefits include:

- Clear understanding of financial strategy alignment

- Smarter investment and cost-optimization decisions

- Improved business scalability and performance

- Stronger collaboration between finance, technology, and leadership teams

Strategic Innovation Drives Smarter Decision-Making

Businesses often struggle with fragmented systems and outdated financial models. A strategic financial speaker explains how innovative approaches streamline processes, improve transparency, and support faster decision-making. This clarity helps organizations respond quickly to market changes and customer demands.

By learning from industry experts, businesses gain a roadmap to modernize financial systems while maintaining control and compliance.

Ideal Events to Invite a Financial Speaker

A financial speaker focused on strategic innovation is ideal for:

- Business conferences and leadership summits

- Corporate strategy meetings

- Financial transformation workshops

- Startup and scale-up events

- Executive training programs

These sessions create meaningful discussions around growth, sustainability, and future-ready financial planning.

Choosing the Right Financial Speaker

When selecting a financial speaker, look for experience in digital transformation, strategic planning, and innovation-driven growth. A strong speaker connects financial insights with real business challenges, making complex concepts easy to understand and apply.

The right expert doesn’t just share theory—they provide actionable strategies that help businesses grow with confidence.

To stay competitive, businesses must rethink how finance supports growth and innovation. Inviting a financial speaker to discuss strategic innovation empowers leaders with insights that drive smarter decisions, stronger systems, and measurable business growth. Whether for a corporate event or industry conference, a strategic financial speaker can be the catalyst for long-term success.

Ready to Bring Strategic Financial Innovation to Your Event?

If you’re planning a conference, leadership session, or corporate workshop and want expert insights on financial strategy, digital transformation, and sustainable business growth, invite Biren Parekh to speak. With decades of experience guiding organizations through strategic innovation, Biren delivers practical, future-focused perspectives that drive real business impact.

Learn more about Biren Parekh and invite him as a financial speaker:

https://www.birenparekh.com/about-me/

Businesses Evolve Faster with Strategic Financial Innovation Leaders Shaping Digital Systems and Growth Pathways

The Role of Financial Innovation in Modern Business Growth

Financial innovation acts as a catalyst for business transformation. By integrating advanced digital tools with strategic thinking, innovation leaders help organizations adapt quickly to market changes.

Key outcomes of financial innovation include:

- Improved operational efficiency

- Faster go-to-market strategies

- Data-driven financial decision-making

- Scalable and secure digital infrastructures

Businesses that embrace strategic financial leadership are better equipped to handle disruption, regulatory changes, and evolving customer expectations.

Why Strategic Financial Innovation Leaders Matter

Strategic financial innovation leaders bridge the gap between technology and business growth. They don’t just implement systems they design financial strategies that support scalability and resilience.

These leaders focus on:

- Aligning financial technology with business objectives

- Optimizing digital transformation investments

- Reducing risk while enabling innovation

- Building agile financial frameworks for long-term growth

Their expertise ensures that digital initiatives deliver measurable business value rather than becoming costly experiments.

Shaping Digital Systems for Sustainable Growth

Modern digital systems form the backbone of business operations. Financial innovation leaders play a critical role in shaping these systems to support scalability, security, and performance.

Key Digital Systems They Influence

- FinTech platforms and digital payments

- Enterprise financial management systems

- Data analytics and AI-driven insights

- Cloud-based financial infrastructures

By designing integrated digital ecosystems, businesses gain better visibility into finances, improve compliance, and enable faster strategic decisions.

Unlocking New Growth Pathways Through Financial Strategy

Growth today is driven by smart financial strategy, not just increased spending. Strategic leaders identify new revenue opportunities by leveraging digital tools and financial insights.

They help businesses:

- Expand into new markets with confidence

- Monetize digital products and services

- Optimize pricing and revenue models

- Improve customer lifetime value

With the right financial innovation strategy, businesses can scale efficiently while maintaining profitability.

Financial Innovation and Digital Transformation Go Hand in Hand

Digital transformation without financial strategy often leads to misalignment and inefficiency. Financial innovation leaders ensure that transformation efforts are strategically planned, financially viable, and outcome-driven.

This integrated approach results in:

- Higher ROI on digital investments

- Reduced operational risks

- Faster adoption of emerging technologies

- Stronger competitive positioning

Businesses that combine digital transformation with strategic financial leadership evolve faster and more sustainably.

The Competitive Advantage of Financial Innovation Leadership

Organizations led by financial innovation experts consistently outperform competitors. They are more agile, data-driven, and prepared for future challenges.

Competitive advantages include:

- Faster response to market changes

- Smarter capital allocation

- Enhanced digital customer experiences

- Stronger long-term growth potential

In a digital-first world, financial innovation leadership is no longer optional—it’s essential.

Businesses evolve faster when guided by strategic financial innovation leaders who shape digital systems and create scalable growth pathways. By aligning finance, technology, and business strategy, organizations can navigate complexity, accelerate transformation, and achieve sustainable success.

As digital ecosystems continue to evolve, companies that invest in financial innovation leadership today will define the future of business growth tomorrow.

How Digital Innovation Experts and Keynote Speakers Guide Modern Business Strategy

Businesses across every industry are going through rapid digital change. New tools, customer expectations, and market demands keep evolving, and companies often struggle to understand which direction to take. This is why many leaders rely on digital innovation experts and keynote speakers to help them make sense of the changes and guide them toward smarter business strategies. These experts bring a mix of industry knowledge, practical experience, and future-focused insight that helps organizations move forward with clarity and confidence.

Digital innovation experts play an important role in simplifying complex technologies. Instead of overwhelming leaders with jargon, they explain trends, tools, and digital opportunities in a straightforward and relatable way. Their goal is to help businesses understand what actually matters, what to invest in, what to avoid, and how to align digital tools with long-term goals. By translating complex ideas into simple, actionable steps, they make technology easier to implement across the organization.

Another powerful contribution these speakers make is helping companies build a future-ready strategy. Modern business success depends on how effectively companies can adopt digital processes, improve customer experience, automate repetitive work, use data for smarter decision-making, and stay prepared for upcoming market shifts. A digital innovation keynote speaker brings examples from real companies, shares lessons learned, and provides practical guidance on how businesses can stay competitive and agile. Their insight is shaped by years of working closely with industries that have already faced major digital changes.

Along with strategic guidance, these experts also bring inspiration. Digital transformation is not just about using new tools it requires a shift in mindset. Employees often resist change because they fear technology or worry about their roles. A strong keynote speaker motivates teams, builds confidence, and encourages a culture that welcomes innovation. When people feel inspired and supported, the transformation becomes smoother and more meaningful.

Businesses that learn from digital innovation experts often see real impact. They make faster decisions, reduce inefficiencies, improve customer loyalty, and discover new opportunities for growth. The combination of practical advice and forward-thinking vision helps companies stay ahead instead of reacting late to market changes.

If you’re looking to strengthen your business strategy with expert insight, Biren Parekh is a trusted voice in digital innovation and financial transformation. His experience, knowledge, and strategic thinking help businesses understand what’s changing and how to adapt with confidence.

To get expert guidance on digital innovation and modern business strategy, connect with Biren Parekh at https://www.birenparekh.com/. He brings clear insight, real-world experience, and practical ideas to help your business prepare for the future.